Travel Insurance Comparison: How to Choose the Best Plan for Your Trip

When it comes to planning a trip, one of the most important things to consider is travel insurance. While it may seem like an extra expense, having the right travel insurance can save you from costly mishaps, offering you peace of mind. However, with so many options available, choosing the best plan can be overwhelming. That’s where a travel insurance comparison becomes essential.

This guide will walk you through everything you need to know about comparing travel insurance, the factors to consider, and how to select the best policy for your travel needs. Whether you’re heading on a short vacation, a long-term adventure, or a business trip, understanding how to compare different policies is crucial.

Why Do You Need Travel Insurance?

Travel insurance can protect you from unexpected expenses that can arise before or during your trip. Whether it’s medical emergencies, trip cancellations, or lost baggage, the right insurance can help mitigate financial loss. Here are some common reasons why you might need travel insurance:

1. Trip Cancellation and Interruption

Unforeseen events like illness, family emergencies, or natural disasters can force you to cancel or cut short your trip. Travel insurance can reimburse you for the non-refundable expenses, giving you financial protection.

2. Medical Emergencies

While traveling abroad, unexpected medical issues can arise. Travel insurance ensures that you won’t have to pay high out-of-pocket costs for medical care, including emergency evacuations.

3. Lost or Delayed Baggage

If your luggage is lost, stolen, or delayed, travel insurance can cover the cost of purchasing replacement items and help you recover your belongings.

4. Travel Delays

Sometimes flights or other forms of transportation are delayed due to weather or mechanical issues. Travel insurance can reimburse you for additional expenses such as hotel stays, meals, and transportation.

Types of Travel Insurance to Compare

There are various types of travel insurance, each covering different aspects of your trip. Understanding the types of coverage available is the first step in making a travel insurance comparison. Let’s break down the most common types of travel insurance policies:

1. Trip Cancellation Insurance

This insurance covers the cost of non-refundable trip expenses if you have to cancel your trip due to illness, a family emergency, or other covered reasons. This is particularly useful for expensive trips or flights with strict cancellation policies.

- Key Benefit: Protects against losing the money you’ve already spent on your trip.

- When to Consider: For expensive vacations or flights that are difficult to cancel.

2. Travel Medical Insurance

Travel medical insurance provides coverage for medical emergencies that happen while you’re traveling. This can include doctor visits, hospital stays, and emergency evacuation services. It’s especially important if you’re traveling to a destination where healthcare might be expensive or difficult to access.

- Key Benefit: Ensures that you’re covered for health emergencies abroad.

- When to Consider: For international trips or trips to countries with high medical costs.

3. Emergency Evacuation Insurance

If you’re traveling to remote locations or countries with limited medical facilities, emergency evacuation insurance becomes essential. It covers the cost of evacuating you to the nearest medical facility in case of a serious injury or illness.

- Key Benefit: Covers emergency evacuation to a medical facility.

- When to Consider: For adventure travel or trips to areas with limited healthcare access.

4. Baggage and Personal Belongings Insurance

This type of insurance covers lost, stolen, or damaged luggage and personal belongings. If your items are delayed, lost, or damaged, this insurance reimburses you for the cost of replacement or repair.

- Key Benefit: Covers loss or damage to your luggage and belongings.

- When to Consider: For those traveling with expensive gear or for long trips.

5. Trip Delay Insurance

Sometimes flights are delayed due to weather or other unexpected factors. Trip delay insurance covers the additional expenses incurred during delays, such as hotel stays and meals.

- Key Benefit: Provides compensation for delays.

- When to Consider: For long-haul flights or international trips with layovers.

How to Compare Travel Insurance Plans

With a wide variety of policies available, it’s important to compare travel insurance plans before making a decision. Here are the key factors to consider during your comparison:

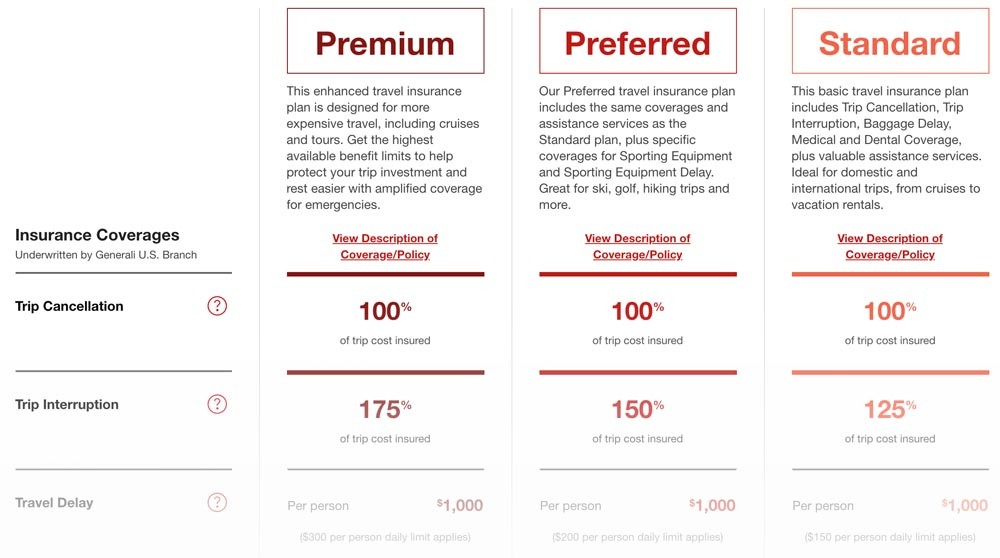

1. Coverage Limits

Every insurance policy has different coverage limits. Be sure to check the maximum coverage limits for each type of insurance, such as medical emergencies, trip cancellations, and baggage loss. Choose a policy with limits that align with your travel needs and budget.

- Tip: Look for plans that offer higher limits for medical emergencies if you’re traveling internationally.

2. Exclusions and Restrictions

Travel insurance policies often have exclusions and restrictions. For example, some policies may not cover pre-existing medical conditions or certain activities like extreme sports. It’s crucial to read the fine print and understand what is and isn’t covered.

- Tip: Ask about any exclusions or restrictions that may apply to your specific travel situation.

3. Price vs. Coverage

Price is always a key factor, but it shouldn’t be the only consideration. Cheaper plans may have less coverage or higher deductibles. Compare the overall value of the policy in terms of both price and coverage.

- Tip: Don’t sacrifice necessary coverage for a cheaper plan—find a balance that suits your needs.

4. Customer Service and Claims Process

In the event that you need to file a claim, you want a travel insurance company with excellent customer service and a straightforward claims process. Look for companies with positive customer reviews and a reputation for handling claims efficiently.

- Tip: Check customer reviews on third-party sites like Trustpilot to gauge the company’s reputation.

5. Policy Customization

Some travel insurance plans allow you to customize your coverage based on your specific needs. This can include adding additional coverage for certain activities or adjusting coverage limits. Look for flexible policies that can be tailored to your trip.

- Tip: Choose a provider that offers customization options if you need specific coverage.

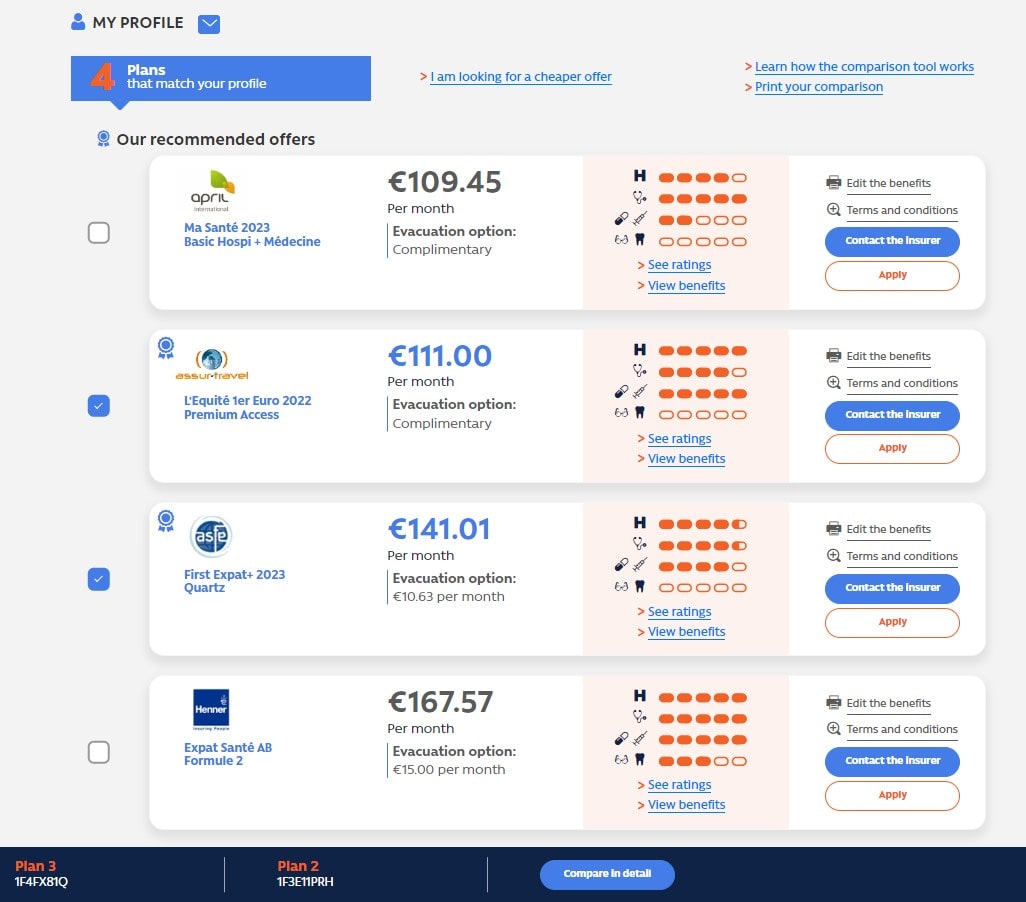

Tools to Help Compare Travel Insurance

To simplify your comparison process, several online tools allow you to compare multiple travel insurance plans at once. These platforms provide an easy way to assess the best coverage for your needs, based on factors like price, coverage, and customer reviews.

- Travel Insurance Review: Offers comparisons between top travel insurance companies, along with detailed policy breakdowns.

- InsureMyTrip: A comprehensive comparison tool that lets you compare policies based on coverage and cost.

- SquareMouth: Helps you compare plans by factors like coverage limits and exclusions.

FAQs About Travel Insurance Comparison

1. How do I know if I need travel insurance?

If you’re traveling abroad, participating in activities like hiking or skiing, or planning a significant investment in your trip, travel insurance is recommended. It provides protection for unforeseen events, ensuring you won’t bear the full cost of an emergency.

2. Can I purchase travel insurance after booking my trip?

Yes, you can typically purchase travel insurance up to the day before you depart. However, it’s best to buy insurance as soon as you book your trip to cover cancellation or other issues that may arise beforehand.

3. What is the difference between trip cancellation and trip interruption?

Trip cancellation covers the cost of canceling your trip before you depart, while trip interruption insurance reimburses you for expenses if your trip is cut short due to unexpected events like illness or an emergency.

4. Are pre-existing conditions covered by travel insurance?

Some policies cover pre-existing conditions, but many do not. It’s important to check the specific terms of the policy or consider purchasing a policy with a “pre-existing condition waiver” if needed.

Conclusion

Travel insurance comparison is an essential part of planning a trip, ensuring you have the right coverage for your needs. By understanding the different types of coverage, comparing plans based on price, coverage limits, and customer reviews, you can make an informed decision. Take the time to research, and you’ll travel with the peace of mind knowing you’re covered in case of the unexpected.

Ready to get started? Use comparison tools like Travel Insurance Review or InsureMyTrip to find the best travel insurance plan for your next adventure. Safe travels!